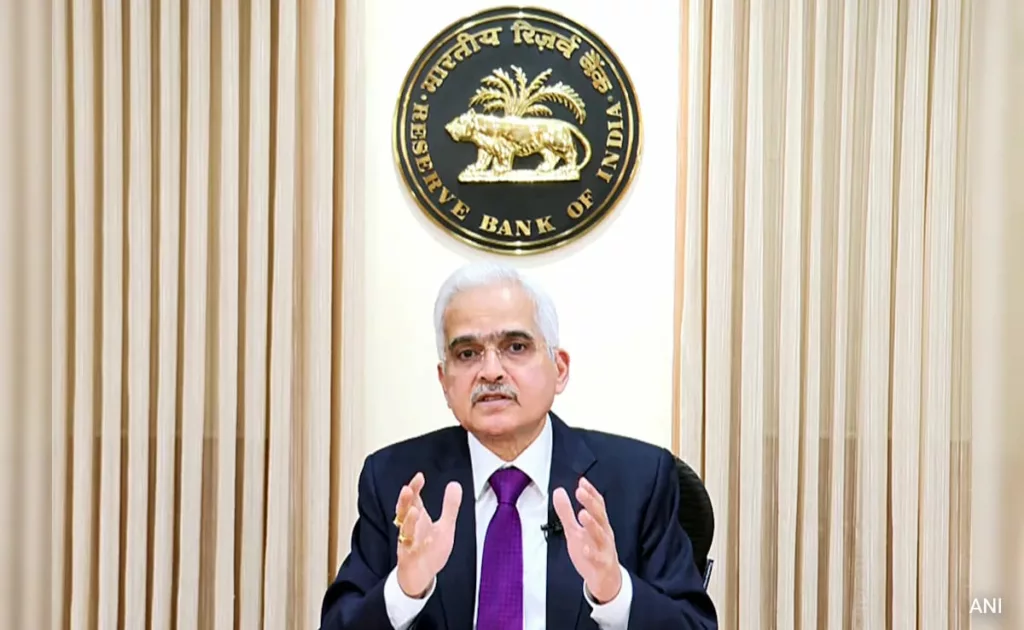

The Reserve Bank of India (RBI) endeavors to smell out a crisis early and act on it, Governor Shaktikanta Das said, stating that not taking any action on the unsecured lending front would have created “bigger problems”.

The November 2023 action to curb growth in the riskier unsecured lending has had the desired impact as the growth in such portfolios slowed down, Mr Das said addressing an international conference on financial resilience at the RBI’s College of Supervisors in Mumbai.

Restrictions on unsecured lending were the result of a view that there could be a potential problem in the credit market because of growth in unsecured lending, he said.

The overall headline parameters were looking good, but there was “clear evidence” of dilution of underwriting standards, lack of proper appraisals, and a mentality to join the bandwagon for driving up the unsecured lending among some lenders, he added.

“We thought if left unattended, these vulnerabilities can become a bigger problem. So, we thought it is better to act in advance and slow down the credit growth,” Mr Das said.

He expressed satisfaction that the RBI’s action has had the desired impact, as the growth in unsecured lending has indeed slowed down.

The growth in credit card portfolios slowed down to 23% from 30% before the RBI’s action, while the growth in bank lending to Non-Banking Finance Companies (NBFC) has slowed to 18% from the earlier 29%.

On November 16 last year, the RBI increased risk weights on unsecured lending and exposure to NBFCs, which made banks set aside larger amounts of capital on such assets.

Mr Das, who has been at the helm of the central bank for over five years now, said that the RBI shifted its approach to be as proactive as possible to ensure systemic stability.

“I cannot afford to say that we are smelling a crisis on every occasion but it is our endeavour to smell out a crisis. It is at the forefront of our agenda,” he said.

This agenda is at the back of the RBI’s mind all the time – to see if something is building up either at the systemic level or at an individual organisation, he said.

The governor asked lenders to look beyond “mindless” growth in profits and keep other factors in mind.

“While business models may be designed to drive profitability and growth, they sometimes contain vulnerabilities that may not be apparent. Pursuit of business growth is important, but it should never come at the expense of taking on unacceptable risks,” he said.

Mr Das also referred to the YES Bank bailout, pointing out that the RBI had been watching developments at the bank closely since late 2018 and had to launch the multi-agency bailout in March 2020, just before the onset of the coronavirus pandemic.

“India’s domestic financial system is now in a much stronger position than it was before we entered the period of the COVID crisis. The Indian financial system is now in a much stronger position, characterised by robust capital adequacy, low levels of non-performing assets, and healthy profitability of banks and non-banking lenders, or NBFCs,” Mr Das said.

The RBI has undertaken a slew of efforts to increase its supervisory function, including making a provision of a detailed presentation to a bank board by an executive director if it finds something amiss and also meeting the auditors of a bank if it feels the need, he said.

The onsite supervision of credit information companies has been made “annual and intense”, the RBI governor added.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)