Hyderabad: Telangana on Thursday stated that it supports the proposed rate rationalisation as part of the GST reforms, but with a proper compensation mechanism. To achieve this, the state proposed that either the present compensation cess be continued, with the amount collected fully allocated to the respective states.

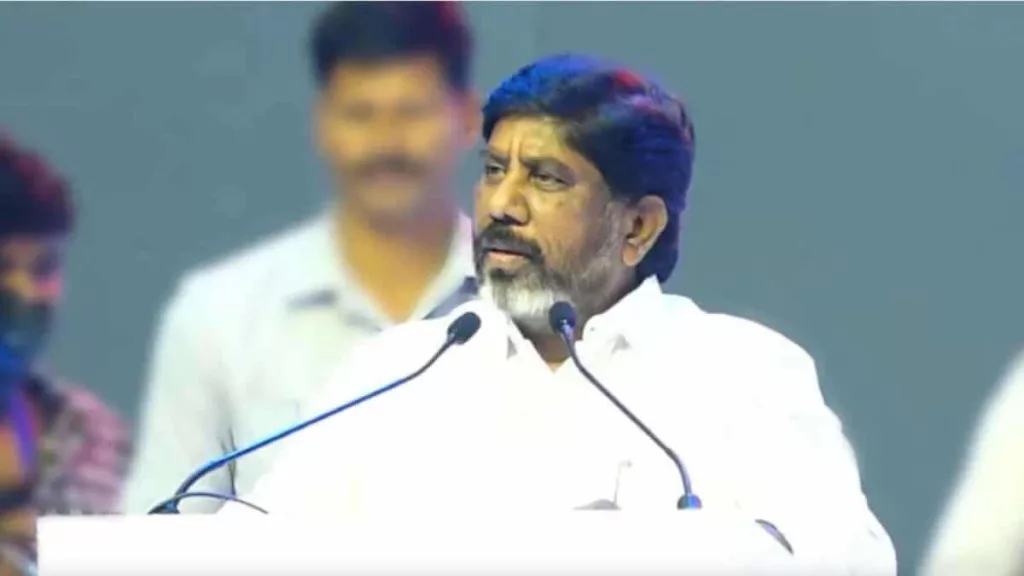

Deputy Chief Minister Mallu Bhatti Vikramarka, who attended a meeting of the Group of Ministers (GoM) on GST rate rationalisation in the national capital, said the proposal of rate rationalisation and reduction of tax burden is always welcome.

He, however, said that it must be balanced by ensuring that the revenues of the states are protected. Otherwise, welfare schemes for poor people and the middle class, as well as infrastructure projects, will suffer.

He further said that, alternatively, while dispensing with the compensation cess, the GST rates on sin or luxury goods may be increased to their present levels, and the additional amount collected may be given to the respective states.

Also ReadModi urges states to cooperate in implementing proposed GST reforms

“Finally, the deputy chief minister supported the proposed rate rationalisation as part of GST reforms, but with a proper compensation mechanism. To achieve this, he proposed that either the present compensation cess be continued, with the amount collected fully allocated to the respective states,” a release said.

“Alternatively, while dispensing with the compensation cess, the GST rates on sin or luxury goods may be increased to their present levels, and the additional amount collected may be given to the respective states,” it added.

According to the state government, Telangana’s proposal will reduce the tax burden on ordinary taxpayers while enabling the state to continue welfare for poorer sections and the middle class, as well as development and infrastructure projects for the people of the state.

The GST Council constitutes the GoM to examine and make recommendations on the rationalisation of GST tax slabs and changes in tax rates.

Vikramarka stated that while introducing GST, the states were growing at a rate of 14 per cent and were therefore assured an annual growth of the same.

To compensate for any losses, GST compensation was introduced for five years to stabilise the growth rate at 14 per cent. However, at present, the states remain at an annual growth of around 8-9 per cent only.

He also maintained that southern states like Telangana, Karnataka, and Tamil Nadu, among others, are getting a far lower share in the form of devolution than their contribution to national revenues, the release added.

Get the latest updates in Hyderabad City News, Technology, Entertainment, Sports, Politics and Top Stories on WhatsApp & Telegram by subscribing to our channels. You can also download our app for Android and iOS.